Federal Budget

Pre-Budget Consultations

Standing Committee on Finance House of Commons

August 2011

Executive Summary

The Canadian Association of Petroleum Producers (CAPP) is the voice of Canada’s upstream petroleum industry, representing companies that explore for, develop and produce more than 90 per cent of Canada’s natural gas and crude oil, a national industry with revenues of about $100 billion per year.

The Canadian upstream petroleum industry can help realize the federal government’s number one priority of economic growth and jobs creation. The Canadian natural gas sector, in particular, can be a significant contributor to this objective. According to the Canadian Energy Research Institute, the natural gas sector has the potential to generate $1.5 trillion in overall economic activity over the next 25 years. This could produce $173 billion in federal tax revenue and create up to 400,000 direct and indirect jobs on an ongoing basis. In order to realize this economic contribution, it is necessary to sustain a viable and competitive natural gas industry in Canada

However, the Canadian natural gas sector is being negatively impacted by challenging market conditions, lack of fiscal competitiveness and a difficult regulatory review process for new projects. Prolonged weakness in continental demand in the face of increasing U.S. shale gas development has led to low commodity prices, reduced Canadian natural gas drilling activity and a severe drop in the Canadian share of the North American natural gas markets.

Canadian natural gas producers are responding to these market challenges by reducing development and operating costs, developing new markets (both domestic and export) and endeavoring to reduce the costs of transportation to markets.

However, as outlined in this submission, there is also a systemic disadvantage to Canadian producers in the total Canadian tax structure for natural gas development, as compared to that which applies to similar competing investments in the U.S. We urge the federal government to take action to close this fiscal gap and to complement the fiscal competitiveness measures implemented in recent years by the provinces.

In particular, CAPP proposes the following temporary accelerated deductibility treatment of natural gas drilling and completion costs:

The federal government will allow Canadian natural gas development and completion costs to be deducted, for a time-limited twenty-four months, at a 50 per cent

This action would have two very important positive impacts. The first is that it would allow Canadian producers to compete on a level playing field with our U.S. natural gas competitors. The second is that it would provide a window in which Canadian producers can advance other measures necessary to sustain the future of the Canadian natural gas producing industry, which benefits all Canadians.

Strengthening the Canadian Economy

The Government of Canada’s stated number one priority is the economy and job creation. The Government has been clear that its mandate is to provide the right conditions for economic growth and job creation a stable, predictable low-tax environment, a highly-skilled and flexible workforce, support for innovation and new technologies, and greater access to more export markets abroad.

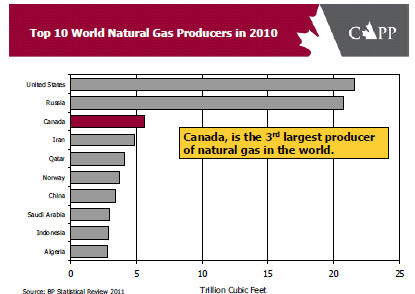

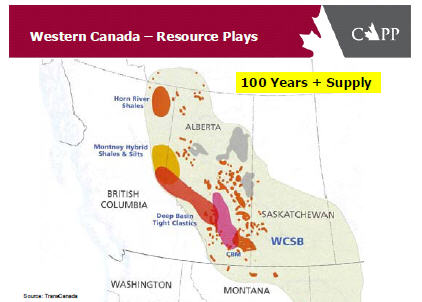

The upstream petroleum industry is an integral part of the Canadian economy. Canada is the world’s third largest producer of natural gas and the sixth largest producer of crude oil. We have over 100 years of supply of natural gas (with tremendous shale reserves) and the third largest reserves of crude oil.

World demand for energy in all forms will continue to grow for decades to come and Canada needs to retain its position as a major energy supplier. We sit next to the US, the second largest consumer of energy and our biggest energy export customer. New energy export potential lies in the growing economies of China, India and other parts of Asia. It is critical for Canadian producers to participate in this tremendous export growth market, but it will take time to develop the necessary infrastructure and export capacity.

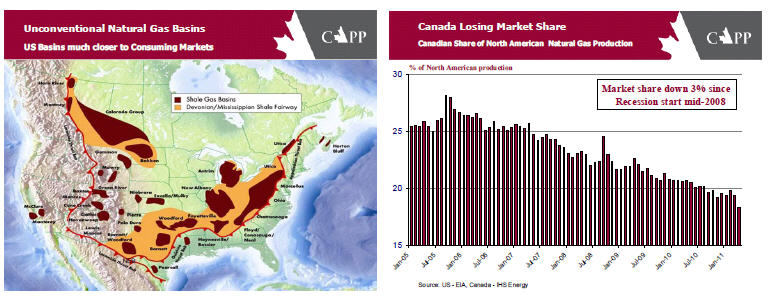

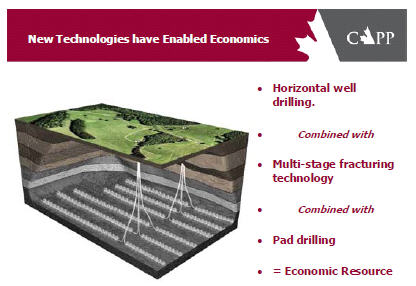

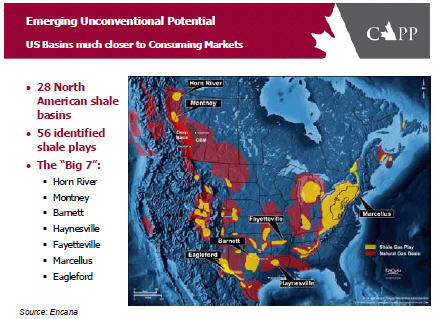

Canadian Natural Gas Production - Landlocked and Losing Market Share

While world demand is strong, in recent years the Canadian natural gas producing sector has faced growing challenges in both export demand and netback prices. Canada’s only current export customer for natural gas, the U.S., has been increasing its domestic supplies of natural gas, including those closer to the large consuming markets on the U.S. Eastern Seaboard. Technological advances in recent years, notably horizontal drilling and fracturing technology, have made shale gas development economic. Combined with the reduced demand arising from the economic downturn, this has led to a sustained period of low natural gas prices continent-wide, and even lower netbacks to Canadian producers further removed from consuming markets.

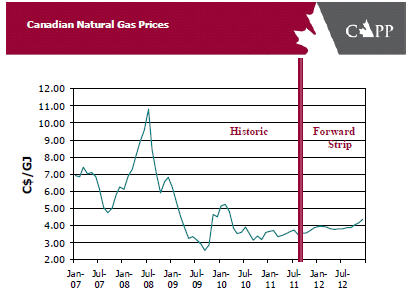

The North American market is essentially landlocked, particularly as it applies to natural gas export capacity. While U.S. demand for Canadian natural gas continues to decline there is currently no access to any other export markets. Infrastructure investment is required, but it will take time to access lucrative Asian markets. These alternative markets could provide both an additional outlet for Canadian production and a potential price uplift. Global markets are now paying $10.00 - $14.00 per thousand cubic feet of natural gas, while Canadian producers face much lower netbacks of $3.00 - $4.00 from North American markets. This price differential results in an ongoing loss in producer revenues, provincial royalties, and federal corporate income taxes. Canadian producers have a real opportunity to capitalize on the energy demand in Asian markets via exports from our west coast. Canada’s fiscal and regulatory competitiveness will be an important factor in realizing this market opportunity.

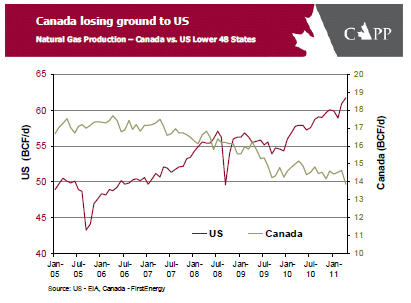

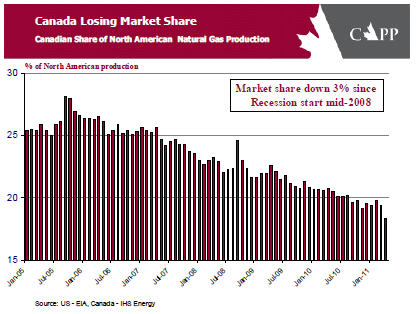

In the meantime, Canadian natural gas continues to lose its share of the North American market. From a high of almost 28 per cent in 2005, our market-share now has dropped to 19 per cent. Absent action by producers and by governments through policy changes, it may well continue to decline. Over three percentage points have been lost since the economic downturn began in 2008, when CAPP first highlighted to the Finance Committee the threat to Canadian natural gas producers. This loss of market share has seen a drop in natural gas export revenues from $35 billion in 2005 down to $15 billion in 2010.

The risk for both the Canadian natural gas industry and the economy is that investment decisions for largescale shale gas developments will continue to be made in favour of U.S. investment. This impacts both the level of investment and resulting economic benefits to the Canadian economy, and the skills, expertise and services infrastructure resident in the sector.

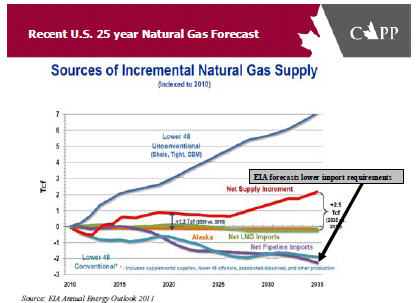

The threat to Canada’s future share of the continental market has been confirmed by the US Energy Information Administration’s (EIA) 2011 annual energy outlook. The EIA forecasts the U.S. will need less and less Canadian natural gas over the next 25 years, with exports to the U.S.2.5 bcf/d by 2035. That represents another loss of 17 per cent of today’s Canadian gas market. Because of growing U.S. self-sufficiency, the EIA forecasts Canada as the only producing area in the world with decreasing production. This highlights the need for a focused, integrated and benefits in Canada.

Fiscal Disadvantage for Canadian Natural Gas

Development

For Canadian natural gas to retain its market share in North America and expand globally, it must be able to compete on a level playing field. U.S. growth in shale gas production is partly driven and supported by an attractive fiscal environment.

The fiscal burden is a combination of federal and provincial royalties and taxes in Canada and federal and state income and production-based taxes in the U.S. While the provinces own most of the oil and gas mineral rights, in the U.S. those rights are held mainly by private land owners. Provincial Crown royalties are, therefore, comparable to a combination of royalty payments to private U.S. land ownersplus production based or severance taxes in U.S. States.

In Alberta and British Columbia, the provinces with the majority of Canadian natural gas production, extensive recent competitiveness reviews have revised the royalty structure for natural gas to promote investment competitiveness with conpeting jurisdictions in both Canada and the U.S.

The other major fiscal impact on investment economics is income tax. The tax structure affects investment economics through two major components: tax rate and the rate of deductibility of capital expenditures. On corporate income tax (CIT) rate, both the federal and provincial governments have taken great strides to improve their competitiveness and reduce their statutory rates. The federal rate is now 16.5 per cent and set to go down to 15 per cent next January 1st. Alberta has been at a low of 10 per cent for a number of years and B.C. has reduced its CIT rate to 10 per cent to match. This produces a combined 25 per cent CIT rate for natural gas producers in the two largest gas producing provinces. By comparison, the U.S. federal CIT rate is at 35 per cent, although comparable states can be significantly lower than 10 per cent - as low as 1 per cent in Texas, for example. Whether on a combined federal-provincial or federal-state basis, or just comparing cross-border federal CIT rates, Canada does have a competitive advantage in terms of the average corporate income tax rate.

The difference in the impact on comparative investment economics is in the rate of deductibility of capital expenditures. The U.S. allows most companies to deduct their drilling and completion costs immediately - in effect, to expense them like operating costs. In Canada, the same Intangible Drilling Costs (IDC) are classified into two distinct categories - exploration and development. While exploration costs have immediate deductibility, development drilling is subject to 30 per cent declining balance under their classification as Canadian Development Expense (CDE). The difference allows companies in the U.S. the ability to write off their expenses in one year, while Canadian producers take about seven years to deduct most of their IDC.

The impact to economics is that in the U.S. taxable income in the first one or two years (or first few years, depending on a company’s taxable position) is much lower than for similar activity in Canada. So, although the CIT rate is higher in the U.S., the actual tax liability in the first few years is lower. These are the years that allow investment to be recouped and reinvested into more development activity. After the first few years tax liability is higher in the U.S. with its higher CIT rate. This makes the U.S. system more backend-loaded than the Canadian tax structure. However, despite the higher CIT rate in the U.S., the frontend lower tax liability has significant impact on project economics, improving overall rates of return for development plays in the U.S. relative to similar investments in Canada.

In the U.S., allowing IDC immediate deductibility, whether for oil or gas and whether for exploration or development, has contributed to U.S. natural gas production growing 20 per cent since 2006, while Canada’s production has dropped 25 per cent over the same period.

This submission has two consultant reports attached, both demonstrating the fiscal disadvantage of Canadian versus U.S. natural gas production. PricewaterhouseCoopers’ (PwC) report, Taxation of Natural Gas Operations in North America, reviews the main U.S. and Canadian tax provisions. Energy Navigator has detailed economic analyses of comparable natural gas plays in Western Canada and select U.S. states. They incorporate all the fiscal measures outlined by PwC and combine them with specific play production, costs and market netbacks. Energy Navigator’s analyses on a very detailed, granular basis, also confirm the competitive advantage of investing in U.S. gas development.

While the U.S. Administration has proposed amending the current treatment of tangible and intangible drilling costs, it is PwC’s opinion that it is unlikely that such changes will occur.

Encouraging Canadian Natural Gas Development

The Canadian natural gas industry faces continuing competitiveness challenges because of a combination of geology, geography, lack of access to expanded export markets and the above systemic tax disadvantage. Producers continue to reduce costs by developing and applying new technology. At the same time, efforts by producers to expand the use of Canadian natural gas in North American markets (such as power generation and transportation) and to secure infrastructure development opportunities to tap into Asian markets are ongoing. The provinces have improved their royalty and tax structures to be more competitive with competing jurisdictions in both Canada and the U.S. While the federal government has reduced its corporate income tax rate and is significantly lower than the U.S. federal tax rate, the backend loading of U.S. tax liability by allowing greater deductibility upfront for drilling and completions still makes project economics more attractive in comparable

CAPP is mindful of the federal government’s current fiscal constraints and its desire to return to a balanced fiscal position by 2014. In order to help address the near-term competitiveness challenges faced by the Canadian natural gas producing industry, CAPP recommends that the federal government allow a temporary accelerated deductibility of natural gas drilling and completion costs. This would backend load more of the tax liability for Canadian production, improving project rates of return and generating additional cash flow for reinvestment and job creation. It would also provide a window in order for Canadian natural gas producers and governments to initiate other action to address the significant competitive

Allowing 50 per cent straight-line deductibility would mean that production in the first year would start paying higher taxes in the third year. Production in the second year would start paying higher taxes in the fourth year. If approved in 2012, federal corporate income tax revenues would be higher in 2015 than they would have been

RECOMMENDATION: The federal government will allow Canadian natural gas development and completion costs to be deducted, for a time-limited twenty-four months, at a 50 per cent straight-line rate.

Summary of Economic Benefits and Costs

Economic Benefits of Time-limited 50 per cent Straight-line Deductibility |

2012 |

2013 |

2014 and Beyond |

Total |

Total Incremental Investment ($ million) |

$183 |

448 |

$265 |

$895 |

Total Jobs Created (person-yrs) |

$2,558 |

6,267 |

$3,709 |

$12,533 |

Federal Government Revenue |

||||

Corporate Income Tax Revenue ($ million) |

(305) |

(746) |

$1,051 |

$0 |

Personal Income Tax Revenue, EI Premiums, E I Payments, CPP Contributions, Net ($ million) |

$80 |

197 |

$117 |

$394 |

Total Incremental Investment ($ million) |

($224) |

($546) |

$1,167 |

$394 |

Between 2012 and 2015, this proposal would produce almost $900 million in incremental capital investment and over 12,500 new jobs. There is an overall net positive benefit over project life to federal government revenues of almost $400 million, although upfront deferral of corporate income tax revenues would reduce federal tax revenues in the near term. The first year impact is estimated at $0.3 billion, with a larger impact in the second year. However, these reductions have offsets through increases in personal income tax, Canada Pension Plan contributions, Employment Insurance (EI) contributions, and decreases in EI payments.

Over the proposal’s twenty-four month window, producers would continue to focus on key actions to address the longer term sustainability of the Canadian natural gas producing sector:

- Reducing unit finding, development and operating costs;

- Advancing access to Asian markets, including development of export infrastructure to the west

- Broadening the use of natural gas in the North American market, particularly in power generation and heavy and return-to-base transportation vehicles;

- Reducing the cost of transportation to key North American markets for Canadian natural gas.

We would also stress that ongoing efforts on regulatory reform, federal and provincial, will play a key role in the competitiveness of Canada’s natural gas sector. We view the development of a modern streamlined regulatory system as essential to protecting the environment, developing our resources and fulfilling the government’s goals of economic growth, job creation and deficit reduction. In particular, we believe regulatory improvement efforts should focus on: improved inter- and intra-governmental coordination; providing process timeliness to ensure timely, effective regulatory decisions; and striking a balance between environmental, economic and energy supply and security objectives.

Summary and Conclusion

The Canadian upstream petroleum industry is a major part of Canada’s GDP. It is the country’s largest private sector investor, a major creator of jobs and a significant source of federal corporate income tax revenues. Its economic contribution helped keep Canada from suffering as much as the rest of the G7 during the economic recession, and it is ready to help realize the federal government’s number one priority of economic growth and jobs creation.

As a known global leader in responsible and sustainable energy development, Canada needs a mix of energy in all forms to meet the needs of a growing country, to ensure a clean energy future and to realize the benefits of global energy trade. Canadian natural gas is the cleanest burning hydrocarbon fuel, a natural foundation in helping Canada achieve its energy and environmental goals.

However, natural gas is facing serious competitiveness challenges because of a combination of geology, geography, access to expanded domestic and export markets, and tax structure. Producers continue to use and develop technology to continuously reduce costs and improve profitability. The provinces have improved their royalty and tax structures to make investment decisions more competitive. At the same time, discussions continue on expanding domestic uses for natural gas in power generation and transportation, and to access lucrative Asian markets. The next two or three years will be critical to determining how seriously discussions are advanced.

While the federal government has made significant reductions in the corporate income tax rate, favorable deductibility tax treatment in the U.S. backend loads tax liability, leading to better project economics, despite the U.S. higher federal tax rates. This has helped cause an increase in U.S. gas production that is eroding Canadian producers’ share of the North American market and keeping commodity prices low.

To ensure the continued viability of Canadian natural gas supply as well as to support the development of export capability to Asian markets, the federal government is urged to add to the fiscal competitiveness measures implemented in recent years by the provinces. CAPP proposes the following temporary accelerated deductibility treatment of natural gas drilling and completion costs:

The federal government will allow Canadian natural gas development and completion costs to be deducted, for a time-limited twenty-four months, at a 50 per cent straight-line rate.

The proposed two year tax deferral would significantly assist Canadian producers to stem the decline in market share of North American production. It would help to ensure that Canada remains an attractive jurisdiction for investment in shale gas development. Without such treatment, investment in Canada could be permanently lost, regardless of any future rebound in market conditions, leaving extraordinary resources stranded and having a commensurate impact on development, jobs, revenue, taxes, and royalties.

APPENDIX - ENCOURAGING CANADIAN NATURAL GAS COMPETITIVENESS

Executive Summary

The Canadian Association of Petroleum Producers (CAPP) is the voice of Canada’s upstream petroleum industry, representing companies that explore for, develop and produce more than 90 per cent of Canada’s natural gas and crude oil, a national industry with revenues of about $100 billion per year.

The Canadian upstream petroleum industry can help realize the federal government’s number one priority of economic growth and jobs creation. The Canadian natural gas sector, in particular, can be a significant contributor to this objective. According to the Canadian Energy Research Institute, the natural gas sector has the potential to generate $1.5 trillion in overall economic activity over the next 25 years. This could produce $173 billion in federal tax revenue and create up to 400,000 direct and indirect jobs on an ongoing basis. In order to realize this economic contribution, it is necessary to sustain a viable and competitive natural gas industry in Canada,.

However, the Canadian natural gas sector is being negatively impacted by challenging market conditions, lack of fiscal competitiveness and a difficult regulatory review process for new projects. Prolonged weakness in continental demand in the face of increasing U.S. shale gas development has led to low commodity prices, reduced Canadian natural gas drilling activity and a severe drop in the Canadian share of the North American natural gas market.

Canadian natural gas producers are responding to these market challenges by reducing development and operating costs, developing new markets (both domestic and export) and endeavoring to reduce the costs of transportation to markets.

However, as outlined in this submission, there is also a systemic disadvantage to Canadian producers in the total Canadian tax structure for natural gas development, as compared to that which applies to similar competing investments in the U.S. We urge the federal government to take action to close this fiscal gap and to complement the fiscal competitiveness measures implemented in recent years by the provinces.

In particular, CAPP proposes the following temporary accelerated deductibility treatment of natural gas drilling and completion costs:

The federal government will allow Canadian natural gas development and completion costs to be deducted, for a time-limited twenty-four months, at a 50 per cent straight-line rate.

This action would have two very important positive impacts. The first is that it would allow Canadian producers to compete on a level playing field with our U.S. natural gas competitors. The second is that it would provide a window in which Canadian producers can advance other measures necessary to sustain the future of the Canadian natural gas producing industry, which benefits all Canadians.

Natural Gas - A Foundational Fuel in Canadian Energy Development

Canadian energy is fundamental to our economy and jobs. It is key to continental energy security and it is essential to our quality of life. Canada is a global leader in responsible, sustainable development and use of energy, benefitting all Canadians and contributing positively to Canada’s international reputation and

Canada requires an energy mix that meets the needs of a growing economy and population, while helping to ensure a clean energy future. Canadian natural gas plays a key role in helping Canada achieve its energy and environmental goals - providing Canadians with tomorrow’s energy today.

Canadian natural gas is a natural foundation in a progressively cleaner energy mix. It is the cleanest burning, commercially available combustion fuel. Technologies using natural gas are highly efficient. This high efficiency, combined with a relatively low CO2 content, makes it a low emission option in a wide variety of uses, including space heating, transportation, industrial application, and electricity power generation.

Canada has a tremendous resource and is one of the largest producers of natural gas in the world. The Canadian natural gas sector creates jobs, is a source of revenue for both federal and provincial governments, and has produced at one point over $35 billion in exports in recent years.

Over the next 25 years, with the right combination of fiscal structure, market development and access to

world markets, natural gas could provide:

- Up to 400,000 direct and indirect jobs across Canada

- $1.5 trillion in overall economic activity ($58 billion per year)

- $173 billion in federal tax revenue

- $132 billion in provincial tax revenue

- $161 billion in royalties

Continuing Reduction in Environmental Footprint

Ongoing technological innovation is helping natural gas producers reduce the environmental footprint of unconventional gas development. Some of these measures include:

- Using a single drilling pad to drill multiple wells, thereby reducing the number of well sites, roads, pipelines and other infrastructure.

- Applying low-impact seismic techniques to eliminate seismic lines.

- Using saline water found in deep aquifers, far deeper than those used for drinking water, to significantly reduce the operations use of surface and ground water.

Natural gas is a fuel that can help reduce greenhouse gasses and other emissions, like sulfur dioxide. The natural gas industry is encouraging greater use of natural gas in key consuming sectors like electricity generation and heavy-use transportation. This can help Canada achieve its emissions reductions goals.

All told, natural gas has the potential to become a truly national industry, creating jobs and tax revenue in all regions of the country, and playing a key role in a safe, reliable low-carbon energy future for Canada and export markets around the world. It must be recognized as a core strategic asset in Canada's energy portfolio.

Competitiveness Challenges

However, despite its long-term potential, in recent years natural gas has faced significant challenges that have reduced its economic contributions to Canada. Facing increasing competition from growing U.S. gas supplies, since 2005, Canadian production has decreased 20 per cent while U.S. production has grown 25 per cent.

This drop in Canadian production has led to a decline in drilling and economic activity, jobs, revenues, export receipts, Crown royalties, and federal and provincial income tax revenues from natural gas.

Canadian natural gas faces challenges in a number of key areas:

- Finding and development costs

- Growing competition from U.S. supplies

- Transportation costs to key North American markets

- Backend loaded U.S. tax structure which encourages investment in U.S. development Lack of access to lucrative Asian markets

- Unrealized potential incremental demand in power generation and transportation

High Finding and Development Costs

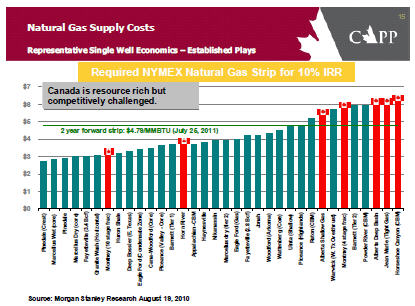

Finding and development costs are higher in Canada than in the U.S because of a number of factors. These include differences in geology, higher labour costs, greater distance from gathering lines and processing facilities, winterization costs, and so forth.

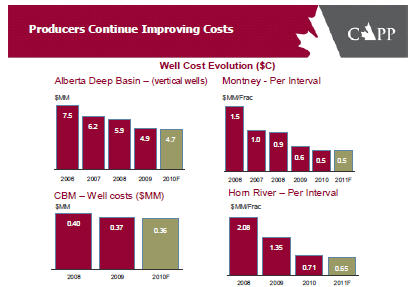

In order to address these costs disadvantages, Canadian producers have worked to reduce costs and increase performance. Producers will continue to develop and adopt new technologies to keep reducing their cost structure.

However, some productivity gains have been offset by factors beyond producer control, such as continuing softness in aggregate U.S. demand and the rise in the value of the Canadian dollar - factors that affect all export sectors of the Canadian economy.

Growing U.S. Supply Competition

Although world demand is strong, Canadian natural gas is restricted to a continental market encompassing the U.S. and Canada. Canada has one export customer for its natural gas - the United States. The U.S. is an enviable customer to have given its position as the world’s second largest consumer of energy. However, technological advancements in recent years have led the U.S. to become less reliant on imported natural gas from Canada.

Developments in horizontal drilling and reservoir stimulation have made it economic to develop natural gas reserves from unconventional sources, like from shale rock. Unconventional formations are found throughout North America, including in historically non-traditional natural gas producing areas in central and eastern Canada and the US. They contain massive amounts of natural gas, many times the order of magnitude of conventional natural gas resources. These new developments are a fundamental

The U.S. has embraced developing natural gas from shale formations, including in non-traditional producing areas close to the large consuming markets on the eastern seaboard (e.g. Pennsylvania). U.S. natural gas production growth has decreased the demand for imports from Canada. Together with ongoing U.S. economic weakness, this growth in U.S. supplies has dampened prices, creating a huge disconnect to world markets. Global markets are now paying $10.00 - $14.00 per thousand cubic feet of natural gas, while Canadian producers face much lower netbacks of $3.00 - $4.00 from North American markets. This low pricing environment is reflected in the forward markets, which expect Canadian natural gas prices to remain soft throughout at least 2012. This price differential results in an ongoing loss in producer revenues, provincial royalties, and federal corporate income taxes.

As mentioned, growing U.S. self-sufficiency has dampened demand for Canadian exports. Export revenues from natural gas have dropped from over $35 billion in 2005 to only $15 billion in 2010.

This threat to Canada’s future share of the continental market is expected to continue well into the future. In its 2011 annual energy outlook, the U.S. Energy Information Administration (EIA) forecasts the U.S. will need less and less Canadian natural gas over the next 25 years. They expect exports to the U.S. to decline potentially by as much as 2.5 bcf/d by 2035. That represents another loss of 17 per cent of today's Canadian gas market. Because of this growing U.S. self-sufficiency, the EIA forecasts Canada as the only producing area in the workd with decreasing production.

The implications are for a continuing decrease in share of the North American producing market for natural gas. This highlights the need for a focused, integrated and strategic response to sustain investment, jobs and benefits in Canada.

Distance from Market Leads to Higher Transportation Costs

Central and Eastern North America and California are the largest markets for Canadian natural gas. New U.S. shale plays are located significantly closer to these markets than Canadian natural gas supplies. This provides a significant transportation cost advantage to U.S. shale investments, $1.00 to $1.50 in transportation differential,

Canadian gas producers and pipeline companies are discussing significant investments in new infrastructure to access new lucrative Asian markets. This could include a new pipeline and a Liquefied Natural Gas terminal in BC. However, even with all regulatory and stakeholder approvals, it will still take years before these significant infrastructure projects are constructed and offshore markets are accessible.

In the meantime, producers continue discussions with existing pipelines on any options for reducing current transportation differentials to existing markets. Pipeline companies and producers alike are both interested in exploring ways of stemming the drop in export volume and pipeline throughput.

Fiscal Structure for Development and Completion Costs

For Canadian natural gas to retain its market share in North America and expand globally, it must be able to compete on a level playing field. U.S. growth in shale gas production is partly driven and supported by an attractive fiscal environment.

The fiscal burden is a combination of federal and provincial royalties and taxes in Canada and federal and state income and production-based taxes in the U.S.

Royalties and Production-based Taxes

While the provinces own most of the oil and gas mineral rights, in the U.S. those rights are held mainly by private land owners. Provincial Crown royalties are, therefore, comparable to a combination of royalty payments to private U.S. land owners plus production based or severance taxes

In Alberta and British Columbia, the provinces with the majority of Canadian natural gas production, extensive recent competitiveness reviews have revised the royalty structure for natural gas to ensure investment competitiveness with competing jurisdictions in both Canada and the U.S. Provincial governments have recognized the importance of unconventional gas development. They have worked closely with natural gas producers to develop and refine their provincial royalty regimes to reflect the unique characteristics and investment

Royalties have been structured to provide front-end relief while initial capital investments are being recovered - improving competitiveness. More efficiency and streamlining are also being made to regulatory frameworks that support operational innovation and the deployment of new technologies, while protecting health, safety and the environment.

Income Tax

The other major fiscal impact on investment economics is income tax. The tax structure affects investment economics through two major components: tax rate and the rate of deductibility of capital expenditures.

Corporate Income Tax Rates

On corporate income tax (CIT) rate, both the federal and provincial governments have taken great strides to improve their competitiveness and reduce their statutory rates. The federal rate is now 16.5 per cent and set to go down to 15 per cent on January 1, 2012. Alberta has been at a low of 10 per cent for a number of years and B.C. has reduced its CIT rate to 10 per cent to match. This produces a combined 25 per cent CIT rate for natural gas producers in the two largest gas producing provinces. By comparison, the U.S. federal CIT rate is at 35 per cent, although comparable states can be significantly lower than 10 per cent - as low as 1 per cent in Texas, for example. Whether on a combined federal-provincial or just comparing cross-border federal CIT rates, Canada does have a competitive advantage in terms of the average corporate income tax rate.

Deductibility of Drilling and Completion Costs

The difference in the impact on comparative investment economics is in the rate of deductibility of capital expenditures. The U.S. allows most companies to deduct their drilling and completion costs immediately - in effect, to expense them like operating costs. In Canada, the same Intangible Drilling Costs (IDC) are classified into two distinct categories - exploration and development. While exploration costs have immediate deductibility, development drilling is subject to 30 per cent declining balance under their classification as Canadian Development Expense (CDE). The difference allows companies in the U.S. the ability to write off their expenses in one year, while Canadian producers take about seven years to deduct 90 per cent of their

The PricewaterhouseCoopers (PwC) report attached to this submission, Taxation of Natural Gas Operations in North America, has a comprehensive review of the main U.S. and Canadian tax provisions affecting natural gas production on both sides of the border.

While the U.S. Administration has proposed amending the current treatment of tangible and intangible drilling costs, it is PwC’s opinion that it is unlikely that such changes will occur.

Impact on Economics and Investment Attractiveness

The impact to economics is that in the U.S. taxable income in the first one or two years (or first few years, depending on a company’s taxable position) is much lower than for similar activity in Canada. So, although the CIT rate is higher in the U.S., the actual tax liability in the first few years is lower. These are the years that allow investment to be recouped and reinvested into more development activity. After the first few years tax liability is higher in the U.S. with its higher CIT rate. This makes the U.S. system more backend-loaded than the Canadian tax structure. However, despite the higher CIT rate in the U.S., the frontend lower tax liability has significant impact on project economics, improving overall rates

The second consultant report attached is from Energy Navigator. It reviews detailed economic analyses of comparable natural gas plays in Western Canada and select U.S. states, incorporating all the fiscal measures outlined by PwC and combining them with specific production profiles, costs and market netbacks for specific plays.

Energy Navigator’s analyses are very detailed and highlight the competitive advantage of directing investment dollars towards U.S. gas development. Key economic measures like after tax rate of return (ROR) and profitto-investment ratio are higher in the U.S. than for similar gas plays in Canada. The analysis shows that the same 100 per cent deductibility in Canada would improve ROR by up to 2.8 per cent. A 50 per cent straightline deductibility would improve ROR up to two-thirds that amount, or up to 1.9 per cent more.

In the U.S., allowing IDC immediate deductibility, whether for oil or gas and whether for exploration or development, has helped contribute to U.S. natural gas production growing 20 per cent since 2006, while at the same time Canada’s production has dropped 25 per cent.

Encouraging Canadian Natural Gas Development

The Canadian natural gas industry faces continuing competitiveness challenges because of a combination of geology, geography, lack of access to expanded export markets and the above systemic tax disadvantage. Producers continue to reduce costs by developing and applying new technology. At the same time, efforts by producers to expand the use of Canadian natural gas in North American markets (such as power generation and transportation) and to secure infrastructure development opportunities to tap into Asian markets are ongoing. The provinces have improved their royalty and tax structures to be more competitive with competing jurisdictions in both Canada and the U.S. While the federal government has reduced its corporate income tax rate and is significantly lower than the U.S. federal tax rate, the backend loading of U.S. tax liability by allowing greater deductibility upfront for drilling and completions still makes project economics more attractive in comparable U.S. jurisdictions.

In order to help address the near-term competitiveness challenges faced by the Canadian natural gas producing industry, CAPP recommends that the federal government allow a temporary accelerated deductibility of natural gas drilling and completion costs. This would backend load more of the tax liability for Canadian production, improving project rates of return and generating additional cash flow for reinvestment and job creation. It would also provide a window in order for Canadian natural gas producers and governments to initiate other action to address the significant competitive

RECOMMENDATION: The federal government will allow Canadian natural gas development and completion costs to be deducted, for a time-limited twenty-four months, at a 50 per cent straight-line rate.

Economic Benefits and Costs

Economic Assumptions

This proposal assumes that 70 per cent of total industry activity is directed toward development, as opposed to exploration. It assumes that 60 per cent of firms are taxable and, therefore, capable of benefitting from this improved tax treatment and resultant cash flow. The reinvestment ratio is assumed to be a very conservative 60 per cent, despite historical averages at 100 per cent or more.

Benefits

Between 2012 and 2015, this proposal would produce almost $900 million in incremental capital investment and over 12,500 new jobs. There is an overall net positive benefit over project life to federal government revenues of almost $400 million.

Economic Benefits of Time-limited 50 per cent Straight-line Deductibility |

2012 |

2013 |

2014 and Beyond |

Total |

Total Incremental Investment ($ million) |

$183 |

448 |

,265 |

895 |

Total Jobs Created (person-yrs) |

$2,558 |

6 267 |

$3,709 |

$12,533 |

Federal Government Revenue |

||||

Corporate Income Tax Revenue ($ million) |

($305) |

($746) |

$1,051 |

0 |

Personal Income Tax Revenue, EI Premiums, EI Payments, CPP Contributions, Net ($ million) |

$80 |

$197 |

$117 |

$394 |

Recettes fédérales totales nettes (millions $) |

$S224) |

($546) |

$1,167 |

$394 |

Costs

CAPP is mindful of the federal government’s current fiscal constraints and its desire to return to a balanced fiscal position by 2014.

The upfront deferral of corporate income tax revenues would reduce federal tax revenues in the near term. The first year impact is estimated at $0.3 billion, with a larger impact in the second year. However, these reductions have offsets through increases in personal income tax, Canada Pension Plan contributions, Employment Insurance (EI) contributions, and decreases in EI payments.

Allowing 50 per cent straight-line deductibility would mean that production in the first year would start paying higher taxes in the third year. Production in the second year would start paying higher taxes in the fourth year. If approved in 2012, federal corporate income tax revenues would be higher in 2015 than they would have been

Why Twenty-four Months?

Over the proposal’s twenty-four month window, producers would continue to focus on key actions to address the longer term sustainability of the Canadian natural gas producing sector. This includes:

- Reducing unit finding, development and operating costs;

- Advancing access to Asian markets, including development of export infrastructure to the west

- Broadening the use of natural gas in the North American market, particularly in power generation and heavy and return-to-base transportation vehicles;

- Reducing the cost of transportation to key North American markets for Canadian natural gas.

We would also stress that ongoing efforts on regulatory reform, federal and provincial, will play a key role in the competitiveness of Canada’s natural gas sector. We view the development of a modern streamlined regulatory system as essential to protecting the environment, developing our resources and fulfilling the government’s goals of economic growth, job creation and deficit reduction. In particular, we believe regulatory improvement efforts should focus on: improved inter- and intra-governmental coordination; providing process timeliness to ensure timely, effective regulatory decisions; and striking a balance between environmental, economic and energy supply and security objectives.

Summary and Conclusions

The Canadian upstream petroleum industry is a major part of Canada’s GDP. It is the country’s largest private sector investor, a major creator of jobs and a significant source of federal corporate income tax revenues. Its economic contribution helped keep Canada from suffering as much as the rest of the G7 during the economic recession, and it is ready to help realize the federal government’s number one priority of economic growth and job creation.

As a known global leader in responsible and sustainable energy development, Canada needs a mix of energy in all forms to meet the needs of a growing country, to ensure a clean energy future and to realize the benefits of global energy trade. Canadian natural gas is the cleanest burning hydrocarbon fuel, a natural foundation in helping Canada achieve its energy and environmental goals.

However, natural gas is facing serious competitiveness challenges because of a combination of geology, geography, access to expanded domestic and export markets, and tax structure. Producers continue to use and develop technology to continuously reduce costs and improve profitability. The provinces have improved their royalty and tax structures to make investment decisions more competitive. At the same time, discussions continue on expanding domestic uses for natural gas in power generation and transportation, and to access lucrative Asian markets. The next two or three years will be critical to determining how seriously discussions are advanced.

While the federal government has made significant reductions in the corporate income tax rate, favorable deductibility tax treatment in the U.S. backend loads tax liability, leading to better project economics, despite the U.S. higher federal tax rates. This has helped cause an increase in U.S. gas production that is eroding Canadian producers’ share of the North American market and keeping commodity prices low.

To ensure the continued viability of Canadian natural gas supply as well as to support the development of export capability to Asian markets, the federal government is urged to add to the fiscal competitiveness measures implemented in recent years by the provinces. CAPP proposes the following temporary accelerated deductibility treatment of natural gas drilling and completion costs:

The federal government will allow Canadian natural gas development and completion costs to be deducted, for a time-limited twenty-four months, at a 50 per cent straight-line rate.

The proposed two year tax deferral would significantly assist Canadian producers to stem the decline in market share of North American production. It would help to ensure that Canada remains an attractive jurisdiction for investment in shale gas development. Without such treatment, investment in Canada could be permanently lost, regardless of any future rebound in market conditions, leaving extraordinary resources stranded and having a commensurate impact on development, jobs, revenue, taxes, and royalties.